Accredited Debt Relief: Easy Steps to Pay Off Your Debt

Introduction:

Accredited Debt Relief is a company that works with people who are in debt and tries to provide services for people with such problems. The company specializes in debt relief services such as debt settlement and debt consolidation in order to reach creditors of their clients for debt forgiveness or in order to have a settlement on a reduced amount for an overall debt.

Accredited Debt Relief is all about offering a suitable strategy to pay off a client’s debts and assisting them to achieve a lasting solution to their problem with a lesser amount to pay than the total balance that they are charged. It mainly targets working people with expenses that do not qualify for secured loans from regulated conventional banks in the country, such as credit card rebates, medical expenses, and other personal loans. Click here

What is Accredited Debt Relief?

Accredited Debt Relief company is a debt settlement firm that offers clients solutions concerning outstanding unsecured debts on their behalf with the intention of coming to a settlement with the creditors. Accreditation Debt Relief helps individuals who still want to qualify for debt relief programs when the debt has become overwhelming and the individual cannot afford to make the payments. They aim at decreasing the total quantity that is due more often for people who have a lot of credit cards or high-interest loans, personal loans, or medical bills.

Accredited Debt Relief is not a full-service debt relief agency, as it provides only settlement, which is the process of travelling with credit companies to reach desired results. While this approach may take some time, it will likely offer a large cut on your overall debt, meaning that you would pay off your dues in a shorter time than if you only made the minimum required payments.

Through our service provider, Accredited Debt Relief, you can combine your payments into a single monthly amount, thus eliminating the stress associated with paying many bills. However, it is important to clarify that debt settlement is not the same as debt consolidation, and the choice of the option depends on several factors.

Why Should People Opt for Accredited Debt Relief Over Other Debt Solutions?

Some of the solutions are debt consolidation, credit counselling, and, of course, bankruptcy. However, there are some specific benefits that people can receive from engaging with Accredited Debt Relief. This is unlike most of the available strategies, which are centred on eliminating interest rates or increasing the timelines of repaying the loans. This makes debt settlement recommendable for those with large debts they cannot manage to pay fully as the collection agencies are gradually pressuring them.

Accredited Debt Relief is also highly rated and accredited by organizations such as AFCC and IAPDA, which shows that it works under the required standards. Its team of professionals will assign its client’s attention so that it can recommend suitable debt relief plans that will suit their conditions.

Choosing Accredited Debt Relief over other options may allow you to:

- Be debt-free faster by lowering the total amount of money you must pay back.

- Never consider filing for bankruptcy, as it will affect your financial life in future.

- Third, it helps consolidate many small and unrelated poor debts by making regular, easy waves of better consolidated secured debt.

When you get help from a reputable service such as Accredited Debt Relief, you deal with professionals who can help you in fairness laws your creditors with no problem at all and help to take control of your debt.

How Accredited Debt Relief Works:

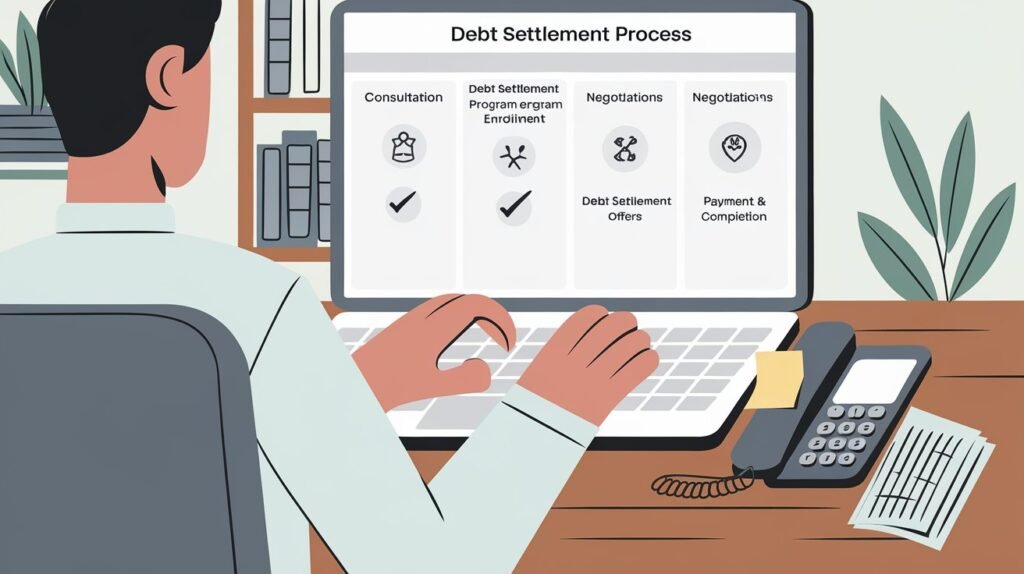

The Debt Settlement Process:

Debt settlement is a process whereby Accredited Debt Relief offers to pay your creditors only a portion of the total amount of the debt. The outlined process starts initially with a consultation, during which a debt specialist reviews your financial profile, establishes an affordable amount of debt to pay, and redesigns how to achieve the targeted debt-free status.

Here’s how the debt settlement process generally works:

- Consultation: In the first visit, an agent from Accredited Debt Relief assesses the current credit status, considering the type of debts incurred, the amount owed, and the ability to make the payments.

- Debt Settlement Program Enrollment: If you decide to proceed, you’ll enrol in a debt settlement program where you’ll deposit money into a savings account regularly. This account shall be held for the purposes of assembling funds to pay off creditors once they are offered to settle their balances.

- Negotiations: After the account has been accredited for a certain amount of money, Accredited Debt Relief will start the initial discussions with your creditors. They are designed to assist you in paying off your debt through a one-time payment that is lower than the full amount payable. Creditors are willing to accept such offers because it is better for them than having nothing if the debtor lodges for bankruptcy.

- Debt Settlement Offers: Once all the negotiations go well, you’ll be offered the settlement offers. These offers will state the percentage of the debt that the creditor is willing to waive in return for the balance.

- Payment & Completion: Once the agreement terms are set, payments are made directly to the creditors out of the savings account. As more debts are paid off, you will continue to make payments until all the enrolled debts have been paid off.

Easy Steps to Pay Off Your Debt with Accredited Debt Relief:

Initial Consultation and Debt Assessment:

The first thing that any debtor needs to do to attain debt relief through this company is to set an appointment with one of their specialists. In this consultation, you go through income and balance sheets, credit card balances, and assessed monthly expenses. This assessment will ensure the specialist is in a position to identify whether indeed debt settlement is the most suitable for your situation.

This stage of a relationship requires honesty to admit your financial problems. They really like to be as honest as you can be about your debts and everything like that. Your specialist will assess the following:

- Total debt amount

- Types of unsecured debts

- Income and expenses

- The capacity of individuals to contribute the required amount in advance to an agreed monthly shutdown fund.

Then, depending on that particular evaluation, the company will recommend debt settlement or other methods, such as debt consolidation or credit counselling.

Creating a Personalized Debt Reduction Plan:

After choosing to proceed with Accredited Debt Relief, the next step is to devise a debt-elimination strategy. This strategy is a clear map of the total amount of money owed to creditors; it also shows the names of these creditors and the general payment plan that can be afforded in the country.

In most cases, the plan will absorb a certain amount of your monthly income to save it in a special savings account. It will be saved until you have enough to pay your creditors, and this is known as a settlement offer. Your personalized debt reduction plan will be based on your:

- Monthly income

- Fixed and variable expenses

- Having the ability to make some contribution to the settlement fund

Writing this plan, I intend to pay off my debts in 24 to 48 months, depending on the overall amount and the amount I am able to save each month.

Negotiation and Debt Settlement Process:

So, after you have been saving for a few months and you have a sizeable amount saved in your settlement fund, Accredited Debt Relief will start negotiating with your creditors. This is where real debt reduction seems to be taking place. Negotiation is the process of convincing the creditors to allow you to pay them less than the agreed amount.

Some creditors will easily agree to adjustments because the last thing they want is not to be paid at all. Depending on the nature of your case and the number of creditors, the negotiation process may be a little lengthy.

When there is a settlement agreement, Accredited Debt Relief will inform you of the new amount of debt. If that’s okay with you, it will be cleared from your settlement account in a lump sum, and that transaction shall consider the particular debt as discharged.

During this process, Accredited Debt Relief represents you and, thus, guarantees the best possible outcome with your creditors. The objective is to pay off the debts for a fraction of the amount that you owe and start your financial life all over again.

Advantages and Disadvantages of Using Accredited Debt Relief:

Advantages of Debt Settlement:

There are several benefits associated with opting for Accredited Debt Relief for debt settlement, and these are explained to make it a lot easier for people who are in huge financial trouble to consider opting for it. Some of the key benefits include:

- Debt Reduction: That is the most obvious benefit because, in most cases, debt settlement helps clients reduce certain debts. Some debts can be written off, cutting them by as much as 20-50%, which definitely comes with significant savings.

- Single Monthly Payment: Instead of paying out all your debts as you are bound to do to your several creditors, you will pay them into a single account…. This will extend your financial ease and reduce the chances of late payment.

- Avoid Bankruptcy: When people are burdened with a tremendous amount of debt, debt settlement is a more viable solution than filing for bankruptcy, which also has more lasting repercussions on your credit scores and future financial prospects.

- Stress Relief: Having faith that a team of experts is managing the debt burdens will ease the burden and pressure surrounding an individual or a company. You can start to move forward and work on your credit while avoiding those ridiculous phone calls.

Potential Drawbacks and Considerations:

Nonetheless, like almost every other program out there, debt settlement has disadvantages. There are some potential drawbacks everyone should be aware of, so here they are.:

- Credit Score Impact: Failing to pay off your debts can lead to more debt; hence, it is very wrong to settle your debts for less than what you owe. Sometimes, when you agree to settle for the aforementioned amounts to pay your debts and perform a credit check, you realise that missed payments and settled debts are also exhibited on the credit check.

- Fees and Costs: Accreditation is achieved based on particular criteria, but for the services offered by Accredited Debt Relief, consumers are charged service fees of about fifteen to twenty-five per cent of the paid-off debt amount. This fee structure can increase costs, which are usually equalized by the settled percentage.

- Time Commitment: Perhaps the best thing to note about debt settlement is that it is not a magic bullet. Usually, it can take 24 to 48 months, depending on your particular financial circumstances. If you need quick discharge solutions, then other options, like filing for bankruptcy, may be better for you.

- Tax Implications: Sometimes, waived or erased liabilities may be treated as taxable income as per the IRS. Debt settlement is another area that should be discussed with a tax advisor and expert to uncover the possible tax implications of the strategy.

However, getting debt through Accredited Debt Relief is still valid for most people who make small wages and cannot meet their bills. National debt and other obligations cause constant demand for payments and make people’s monthly payments more reasonable for long-term financial freedom.

Alternative Debt Relief Options to Consider:

Debt Consolidation:

If debt settlement is not the solution, you may opt for a debt consolidation program. Debt consolidation means the act of taking one or several debts and changing them into one loan with a lower rate of interest. These programs can help make your payment process easier and lower your monthly payment.

Nevertheless, unlike what we came across in the case of Accredited Debt Relief, debt consolidation doesn’t erase any of the debt that you owe. You still have to pay off the entire debt but with a lower interest rate. Consolidation is most effective for those with good credit standing but who desire an easier method of paying their loans.

Bankruptcy as a Last Resort:

Bankruptcy should always be the last option; despite that, it is the only solution to their financial problems for some people. Bankruptcy lets you discharge debts or create a payment plan regarding secured debts. Nonetheless, once one files for bankruptcy, they are likely to lose some of the most important things in life since it is a black mark against their credit, and anyone who wishes to give them a loan, a line of credit, credit cards or even a rental agreement will not do so easily.

To avoid going bankrupt, it is always advisable to look for other remedies, such as taking debt settlement from Accredited Debt Relief to know if the effects associated with the bankruptcy filing will not have serious consequences.

Please read through the FAQs of accredited debt relief below:

Q1. How long does the debt settlement process take?

Ans: The debt settlement process can take anywhere from 24 to 48 months, depending on how much debt you have and how much you can save each month for settlements.

Q2. In other words, how long does the credit and collection agency take to get involved in debt settlement?

Ans: The whole debt settlement process may take a little more time, on average, 24 to 48 months, depending on your ability to make additional payments and the existing amount of your debts.

Q3. How does the debt settlement process impact my credit score?

Ans: Of course, paying your debts off at a lower amount than the assigned credit can bring about a decline in your score. However, this is often temporary, and as soon as you cancel all your debts, you can always start repairing your credit.

Q4. What fee does Accredited Debt Relief have?

Ans: Accredited Debt Relief requires clients to pay fees ranging from 15% to 25% of every settled account. All these fees are usually deducted from your savings during the settlement period.

Q5. Payment is one major problem that many debtors struggle to meet, so what happens if I can’t make the payments?

Ans: If you cannot make the stipulated payments into your settlement account, the settlement process may be slow, or even aggressive actions from the creditors may resume. You have to tell the company as soon as possible about any changes that occur in your fundraising circumstances.

Q6. Is Accredited Debt Relief a scam or really a legitimate service?

Ans: Accredited Debt Relief is a real debt settlement agency recognized by accredited bodies such as AFCC and IAPDA.

Conclusion:

Accredited Debt Relief is a service that can be easily recommended to those who are experiencing difficulties in paying consolidated unsecured obligations. They offer an easily affordable option of making people have no debts since they assist in repaying reduced amounts of the money owed. While this may sometimes take time and be unfavourable to your credit score, it is more advisable than filing for bankruptcy or continue making payments that one cannot afford. If you are overwhelmed by your debt, the first step that you should consider is to talk to Accredited Debt Relief about your options.

“TO READ MORE ARTICLES SO CLICK HERE”

“TO READ MORE ARTICLES SO CLICK HERE”

Suggestions LINK’S:

Lytle Loans Athens TN: How to Secure Fast and Reliable Loans Locally

How to Navigate the World of Online Payday Loans Without Getting Trapped

How Admiral Car Insurance Keeps You Protected on Every Drive

Payday Loans and Eloanwarehouse: A Comprehensive Overview

The Rising of Robotics and Transforming our in Wonderful World